Who is Eligible for Wage Parity?

Who is Eligible for Wage Parity? Wage Parity benefits are accessible to all hourly home consideration laborers or assistants who a...

What is the difference between Revenue Account and Capital Account?

What is the difference between Revenue Account and Capital Account? Revenue account is an account that includes all the revenue re...

How to import a QBO file into QuickBooks Desktop

How to import a QBO file into QuickBooks Desktop. Once you make a bank rule in QuickBooks desktop then accounting becomes easier a...

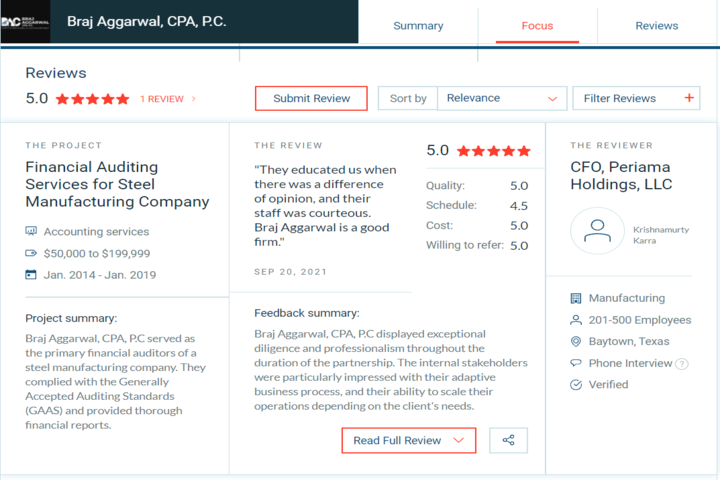

Braj Aggarwal, CPA, P.C Year In Review on Clutch for 2021

Looking for a trusted CPA and accounting team? Struggling with your bookkeeping and taxation efforts? Fret not because Braj Aggarw...

Understanding the Concept of Capital Gain

Understanding the Concept of Capital Gain. The buy asset at one price and sell asset at higher price this type of profit known as ...

Braj Aggarwal, CPA Records A 5-Star Rated First Review On Clutch

At Braj Aggarwal, CPA, numbers only tell part of the story. Our entrepreneurial-minded and results-focused approach is what ensure...

The Earned Income Credit (EIC)

The earned Income Credit (EIC) is a refundable tax credit to U.S. taxpayer with the low earnings to reduce the amount of tax owed ...

The Additional Child Tax Credit

The Additional Child Tax Credit (ACTC) was a separate reduction, but it applied only to families with earned income above $3,000. ...

Insight to major amendments in MD&A adopted by SEC

The Security Exchange Commission, as per its press release on November 19, 2020, voted to adopt amendments to Regulations S-K, tha...

Taxation: What is Form 1040 and who must file this form

Form 1040 is the U.S. Individual Income Tax Return used by U.S. taxpayers to file their annual income tax return with IRS. This fo...