What You Need To Know About HUD Audit

What is HUD Audits?

HUD audits refer to audits performed on housing programs and activities funded by the U.S. Department of Housing and Urban Development (HUD). These audits are done to ensure compliance with federal regulations, proper use of funds, and effective program management. The purpose of HUD audits is to promote accountability, transparency, and to prevent waste, fraud, and abuse of taxpayer funds. They are also an important tool to monitor program performance and identify areas for improvement.

Here's what you need to know about a HUD audit:

Purpose: A HUD audit is conducted to ensure that recipients of HUD funding are in compliance with federal regulations and are using funds appropriately.

Types of audits: HUD audits can be financial, programmatic, or a combination of both. Financial audits focus on compliance with accounting and financial reporting requirements, while programmatic audits assess compliance with program requirements and the proper use of funds.

Preparation: You should prepare for a HUD audit by gathering all relevant financial and program records, and by reviewing the federal regulations that apply to your specific program.

Process: The audit process typically begins with a notice from HUD, followed by on-site inspections and a review of records. The auditor may also request additional information or clarification.

Outcome: The outcome of a HUD audit can result in findings of non-compliance, which must be addressed through corrective action. If the findings are not addressed, HUD may take enforcement action, including the withholding of funds.

Importance: It is important to take HUD audits seriously and to take appropriate measures to prepare and respond, as the outcome of an audit can have a significant impact on your organization's financial and operational stability.

How CPA Firm Deal With a HUD Audit.

CPA firms typically deal with HUD audits by following these steps:

Preparation: Reviewing client records, policies, and procedures to ensure compliance with HUD regulations and guidelines.

On-site Audit: Conducting an on-site visit to gather information and data necessary to complete the audit.

Testing: Performing testing to verify compliance with HUD regulations and guidelines, such as evaluating procurement procedures, financial records, and rent calculations.

Report preparation: Drafting a report detailing the findings of the audit and making recommendations for improvements, if necessary.

Resolution: Assisting the client in resolving any findings or recommendations identified during the audit, such as implementing new policies and procedures or making adjustments to financial records.

Close-out: Finalizing the audit and providing the client with a final report for submission to HUD.

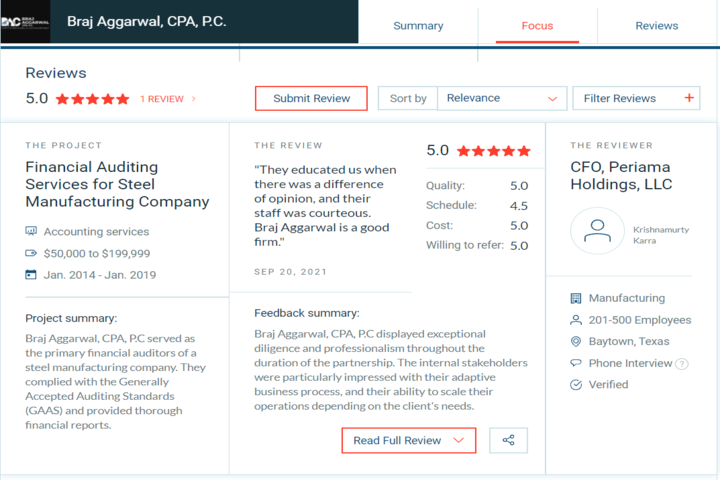

If you are searching HUD Auditor in New York and nearby you then Braj Aggarwal, CPA, P.C. is the best option for you. We have highly experienced HUD Auditor teams and they ensure that the client is in compliance with all applicable regulations, to identify any areas for improvement, and to provide recommendations to enhance program management and accountability.