Understanding Mortgage Banking Audit: How CPAs Can Provide Essential Support

In the complicated global of mortgage banking, making sure compliance, accuracy, and transparency is crucial. Mortgage banking audits play a pivotal role in keeping the integrity of financial establishments and protective both lenders and debtors. In this blog we're going to discuss into the importance of loan banking audits and explore how Certified Public Accountants (CPAs) can help in mortgage banking audits.

Why Mortgage Banking Audits Matter

Mortgage banking audits are complete examinations of a economic institution's mortgage activities, processes, and records. These audits serve numerous essential functions:

Compliance Assurance: Mortgage banking audits verify that the group is adhering to all applicable laws, regulations, and enterprise standards, together with those set forth with the aid of regulatory bodies which include the Consumer Financial Protection Bureau (CFPB) and the Federal Housing Administration (FHA).

Risk Mitigation: By figuring out ability risks, mistakes, or irregularities in mortgage operations, audits assist mitigates the organization's publicity to economic, criminal, and reputational risks.

Accuracy Verification: Audits ensure the accuracy and reliability of monetary reporting associated with loan activities, together with loan origination, servicing, and securitization.

Fraud Detection: Mortgage banking audits encompass methods designed to discover any symptoms of fraud or misconduct, defensive both the group and its clients from fraudulent activities.

How CPAs Can Help with Mortgage Banking Audits

Certified Public Accountants bring specialised expertise, abilities, and know-how to the desk, making them precious partners inside the mortgage banking audit method. Here's how CPAs can provide crucial help:

Regulatory Compliance: CPAs own a deep information of regulatory requirements governing mortgage banking operations. They can assist monetary establishments interpret and navigate complex guidelines, making sure compliance at each step of the audit system.

Risk Assessment: CPAs are adept at identifying and assessing risks inherent in loan banking sports. Through threat evaluation and evaluation, they can assist institutions prioritize regions of awareness and develop techniques to mitigate ability risks efficiently.

Audit Planning and Execution: CPAs play a relevant position in planning and executing mortgage banking audits. They layout audit methods tailored to the organization's specific dangers and targets, conduct fieldwork, and acquire applicable evidence to support their findings.

Data Analysis: With their analytical competencies and scalability in information analysis gear, CPAs can analyze large volumes of loan information to pick out patterns, tendencies, and anomalies which could imply regions of problem or opportunities for improvement.

Internal Control Evaluation: CPAs check the effectiveness of internal controls governing mortgage operations, figuring out weaknesses and recommending enhancements to reinforce controls and guard belongings.

Reporting and Recommendations: CPAs put together comprehensive audit reports that talk findings, observations, and recommendations to key stakeholders, such as management and regulatory authorities. Their insights and tips help power non-stop development and make sure responsibility.

FAQ: Mortgage Banking Audits

What is a mortgage banking audit, and why is it important?

A mortgage banking audit is a comprehensive examination of a financial institution's mortgage activities, processes, and records. It's vital for ensuring compliance with regulations, mitigating risks, verifying accuracy in financial reporting, and detecting fraud.

How often should mortgage banking audits be conducted?

The frequency of mortgage banking audits can vary depending on factors such as regulatory requirements, the institution's risk profile, and internal policies. However, it's generally recommended to conduct audits at least annually, with more frequent audits for high-risk areas.

What are the key areas covered in a mortgage banking audit?

Mortgage banking audits typically cover various aspects of mortgage operations, including loan origination, underwriting, servicing, securitization, compliance with regulatory requirements, internal controls, and fraud detection.

How can Certified Public Accountants (CPAs) assist with mortgage banking audits?

CPAs bring specialized knowledge and expertise in regulatory compliance, risk assessment, data analysis, internal controls evaluation, and reporting. They play a crucial role in planning, executing, and reporting on mortgage banking audits, providing invaluable support to financial institutions.

What are some common challenges faced during mortgage banking audits? Common challenges include interpreting and navigating complex regulatory requirements, assessing the effectiveness of internal controls, analyzing large volumes of mortgage data, and staying abreast of evolving industry trends and best practices.

How can financial institutions benefit from partnering with experienced CPAs for mortgage banking audits?

By partnering with experienced CPAs, financial institutions can enhance transparency, strengthen controls, improve compliance with regulations, mitigate risks, detect, and prevent fraud, and ultimately build trust with stakeholders.

What steps can financial institutions take to prepare for a mortgage banking audit?

Financial institutions can prepare for a mortgage banking audit by conducting internal assessments of compliance, risk management, and internal controls; organizing and maintaining accurate records; addressing any identified deficiencies or areas of concern proactively; and engaging with experienced CPAs for guidance and assistance.

How can financial institutions leverage the findings and recommendations from mortgage banking audits to drive continuous improvement?

Financial institutions can use the findings and recommendations from mortgage banking audits to identify areas for improvement, enhance policies and procedures, strengthen internal controls, provide additional training to staff, and demonstrate a commitment to compliance and risk management excellence.

What are some emerging trends and developments in mortgage banking audits that financial institutions should be aware of?

Emerging trends include increased regulatory scrutiny, advancements in technology for data analysis and fraud detection, evolving best practices in risk management and internal controls, and the growing importance of environmental, social, and governance (ESG) considerations in mortgage lending.

How can financial institutions stay informed about the latest developments and best practices in mortgage banking audits?

Financial institutions can stay informed by regularly monitoring regulatory updates, participating in industry associations and events, engaging with peers and industry experts, seeking guidance from experienced CPAs, and investing in ongoing training and professional development for their staff.

Conclusion:

Mortgage banking audits are essential for preserving the integrity and balance of financial establishments in a complicated and exceptionally regulated industry. With their understanding in regulatory compliance, threat evaluation, data evaluation, and inner controls, Certified Public Accountants play an important position in helping mortgage banking audits and assisting institutions gain their compliance and threat control targets.

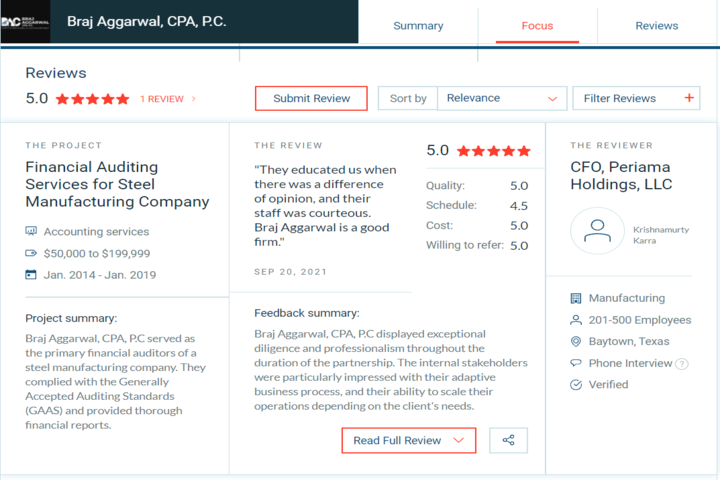

By partnering with Braj Aggarwal experienced CPA firm mortgage creditors and servicers can decorate transparency, reinforce controls, and construct believe with stakeholders, in the end contributing to the long-time period achievement of their groups.

For expert help with loan banking audits and compliance, do not forget partnering with Braj Aggarwal, CPA, P.C. reputable CPA firm in New York that specializes in economic offerings and regulatory compliance.