Understanding IRS notices or letters

Navigating IRS notices can be a daunting task for many taxpayers, but understanding how to handle them can alleviate stress and ensure compliance with tax obligations. These communications from the Internal Revenue Service address various issues, such as confirming tax refunds, clarifying discrepancies in tax returns, or requesting identity verification.

Upon receiving an IRS notice, it's crucial to approach it with careful attention. Each notice carries a specific CP (Computer Paragraph) or LTR (Letter) number on the top right corner, which helps identify its purpose.

Here’s a step-by-step guide to effectively manage an IRS notice:

1. Thorough Review: Start by thoroughly reading through the notice. Understand its contents and what actions, if any, are required from you. IRS notices typically detail changes to your tax return, outstanding balances, or necessary steps to resolve discrepancies.

2. Verify Accuracy: Compare the information in the notice with your records. If you believe there is an error, gather relevant documents that support your case. Accuracy is crucial to avoid penalties or incorrect tax liabilities.

3. Act Promptly: Respond promptly to any requests or deadlines stated in the notice. Timely action can prevent further penalties or accruing interest on unpaid amounts. Addressing issues promptly demonstrates compliance with IRS regulations.

4. Contact the IRS if Needed: If you have questions or need clarification, contact the IRS directly at 800-829-1040. Have the notice handy when you call and be prepared to verify your identity for security purposes.

5. Maintain Detailed Records: Keep thorough records of all communications with the IRS. Save copies of the notice received, any correspondence you send in response, and any documentation provided. These records help track the progress of your case.

6. Consider Professional Assistance: If the notice is complex or challenging to resolve on your own, consider consulting a tax professional. They can provide tailored guidance and help navigate IRS procedures effectively.

7. Beware of Scams: Verify the authenticity of the notice. The IRS does not initiate contact through email, text messages, or social media channels. Contact the IRS directly if you suspect any communication is fraudulent.

What types of notices does the IRS send?

The IRS issues a variety of notices tailored to different tax situations, each demanding specific actions from taxpayers. Here’s an overview of some common types of IRS notices:

1. CP14: Notice of Unpaid Taxes - This notice is sent when taxes are owed and have not been paid. It informs taxpayers about the outstanding balance and includes instructions on how to make payment.

2. CP2000: Notice of Proposed Changes - The IRS sends this notice when inconsistencies are found between the information reported on a tax return and data received from third parties (e.g., employers or financial institutions). It proposes adjustments to the tax return based on these discrepancies.

3. CP501: Reminder of Balance Due - A reminder notice indicating an outstanding balance from a previous notice. It prompts taxpayers to submit payment to settle the debt promptly.

4. CP503: Second Reminder of Unpaid Taxes - This follow-up notice is sent if there has been no response to the initial notice regarding unpaid taxes. It reiterates the urgency of addressing the outstanding balance.

5. CP504: Final Notice of Intent to Levy - Issued as a warning that the IRS intends to levy assets if the outstanding tax debt is not resolved. It emphasizes the consequences of continued non-payment

6. CP3219A: Notice of Deficiency - This notice signals that the IRS has proposed changes to the tax return, potentially resulting in additional taxes owed. It provides an opportunity for taxpayers to dispute these proposed changes.

7. CP75: Documentation Request - Sent to request additional documentation to substantiate specific credits or deductions claimed on a tax return. Providing the requested documents is essential for verifying the accuracy of the tax filing.

8. CP Notice 191: Notice of Failure to File - Notifies taxpayers who failed to file their tax return by the due date, highlighting the need to fulfill their filing requirement promptly.

9. LTR (Letter) 1722: Tax Return Adjustment - Informs taxpayers about adjustments made by the IRS during the processing of their tax return, outlining changes that may affect tax liabilities or refunds.

10. CP88: Request for Information - This notice is issued if additional information is needed from taxpayers who have claimed a refund. Providing the requested information promptly facilitates the processing of the refund claim.

Each IRS notice serves a distinct purpose and requires careful attention to the instructions provided. It is advisable to read notices thoroughly, understand the implications, and take appropriate action as outlined. For clarification or assistance with any notice received, taxpayers can contact the IRS directly or seek guidance from a qualified tax professional.

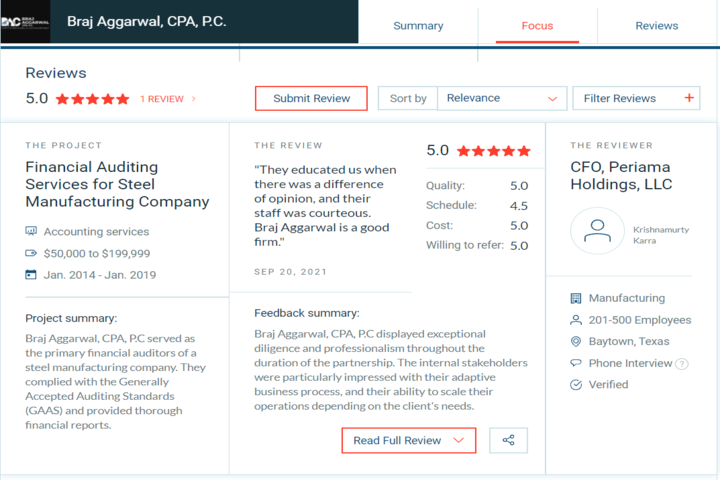

How Braj Aggarwal, CPA, P.C helps?

Navigating IRS correspondence can feel overwhelming, but at Braj Aggarwal, CPA, P.C. we know tax rules inside out and can help interpret those tricky IRS notices. Our team provides clear guidance on necessary actions, ensuring everything is managed accurately and promptly. Being a licensed CPA professional, we have a privilege of having a separate practitioner line with IRS, which provide an edge to resolve the issue quickly. This not only eases your worries but also keeps you out of trouble with potential fines. With our support, you can approach IRS letters confidently, knowing seasoned professionals are dedicated to safeguarding your financial interests.