The Edge of Technological Advancement: Transforming Finance with Virtual CFO Services

In today's fast-paced business environment, advancements in technology are significantly reshaping the finance function. The traditional role of the CFO has expanded beyond merely overseeing financial reporting and compliance; it now includes providing strategic guidance and fostering innovation. Enter the Virtual CFO (vCFO) a contemporary solution that utilizes digital tools to enhance financial operations and promote organizational growth.

What is a Virtual CFO?

A Virtual CFO delivers expert financial management services remotely, offering the flexibility and scalability that modern businesses require. By leveraging advanced technologies, vCFOs provide insights and strategies that improve decision-making, streamline operations, and support sustainable growth.

Key Benefits of Engaging a Virtual CFO

- vCFOs uses innovative financial software for real-time insights which helps in improving forecasting and adaptability.

- Hiring a vCFO helps to reduce overhead costs, thereby allowing for better resource allocation.

- As businesses expand, vCFOs offer adaptable solutions to meet evolving financial needs without the necessity of additional hires.

- vCFOs employ advanced analytics to identify trends and risks, facilitating proactive decision-making and thereby making optimum utilization of resources.

- vCFOs streamline compliance processes and mitigate risks, thereby reducing the likelihood of costly errors and penalties.

- Beyond basic financial management, vCFOs assist with mergers, capital allocation, and long-term planning for sustainable growth.

- Their diverse experience across various sectors allows for tailored solutions that address unique business challenges.

- Outsourcing financial management allows businesses to concentrate on their strengths, weakness along with SWOT analysis of competitors.

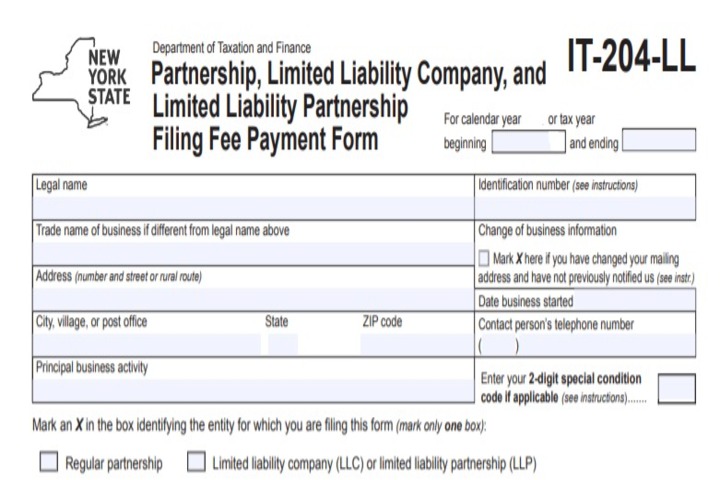

- Regular financial reviews by vCFOs assist in pro-active decision-making regarding sales tax and estimated tax that has to be paid with IRS.

- They often bring valuable industry contacts to improve the relationship with the various industry experts.

- vCFOs integrate financial objectives into broader business strategies for cohesive planning.

The Role of Technology in Virtual CFO Services

- vCFOs uses automating tasks such as invoicing and payroll, which reduces the errors and allows more time for strategic initiatives.

- Recently emerged technology, Cloud technology enables vCFOs to access data from anywhere, improving collaboration and real-time decision-making.

- Use of Advanced tools by vCFOs present complex data clearly, which ultimately enhances the stakeholder understanding and informed choices.

- vCFOs use modeling tools to simulate various financial scenarios, which prepares the businesses for diverse outcomes.

- Creation of a unified technological ecosystem by the vCFOs, improves the data accuracy and providing a comprehensive financial overview.

- Dashboards allow for ongoing monitoring of key performance indicators, facilitating timely adjust Digital platforms enable seamless collaboration and keep all stakeholders informed.

- Sophisticated tools available with vCFOs, facilitate detailed simulations, assist in data-driven investment decisions.

- vCFOs implement strong security protocols and measures to safeguard sensitive financial data.

- Technology keeps vCFOs informed about regulatory changes and market trends, ensuring they provide relevant advice.

- These technologies analyze data for trends and patterns, enhancing strategic planning capabilities.

- Digital tools streamline the auditing process, ensuring accurate records and regulatory compliance.

FAQ on Virtual CFO Services and Technology

What is a Virtual CFO (vCFO)?

A Virtual CFO is a financial expert providing remote management services to businesses, leveraging technology for strategic insights and enhanced financial operations.

What are the main benefits of hiring a vCFO?

- Cost Efficiency: Lower overhead compared to a full-time CFO.

- Access to Expertise: Specialized financial knowledge across various industries.

- Scalability: Easily adjustable services to match business growth.

- Timely Insights: Regular financial reviews support informed decision-making.

- Focus on Core Business: Enables internal teams to concentrate on their strengths.

How does technology enhance vCFO services?

Technology enables:

- Real-time Data Access: Timely decision-making with current financial information.

- Automation: Streamlining repetitive tasks, reducing errors.

- Data Analytics: Deeper insights into financial performance.

- Integration: Seamless communication across financial systems.

What types of technology do vCFOs typically use?

vCFOs utilize: ERP systems, FP&A tools, BI tools, Cloud based accounting software, Predictive Analytics and AI solutions.

How can a vCFO help with compliance and risk management?

A vCFO ensures regulatory compliance through automated reporting and accurate record-keeping, utilizing data analytics to identify and address risks proactively.

What industries can benefit from vCFO services?

vCFO services are beneficial for various industries, including technology, manufacturing, retail, healthcare, and startups.

How does a vCFO contribute to strategic planning?

A vCFO aligns financial goals with business objectives by facilitating planning sessions and providing insights into performance metrics.

How do I choose the right vCFO for my business?

Consider their industry experience, familiarity with your technologies, references, and alignment with your business goals.

What are some common misconceptions about vCFOs?

- Misconception: They only provide basic bookkeeping.

- Reality: vCFOs offer comprehensive financial management, including strategy and risk management.

- Misconception: Hiring a vCFO means losing control.

- Reality: vCFOs work collaboratively with your team, providing insights while you maintain oversight.

How we can help?

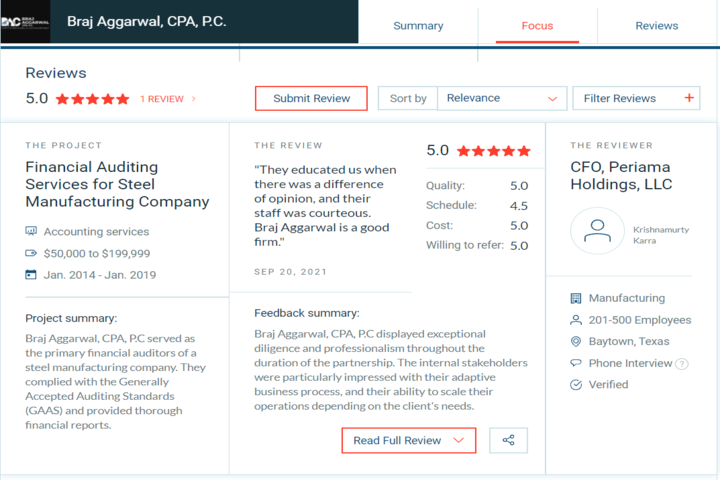

As technology continues to evolve, so does the role of the CFO. Braj Aggarwal, CPA, P.C are leading this transformation, equipping businesses with the agility and expertise necessary to succeed in a complex landscape. By leveraging digital tools and strategic financial management, we empower organizations to navigate challenges and seize growth opportunities.

Embracing us, can significantly enhance financial performance and strategic positioning. In a world where every decision matters, having a trust with us, can truly make a difference.

Let’s partner in your success story! Feel free to reach out to us at Braj Aggarwal CPA, P.C.