Record to Report (R2R): A key Component of Financial Management

Record-to-report (R2R) is a crucial component of a well-managed organization. It depends on the prompt and precise capture of accounting data, which is then used to generate reports, which guide strategic decision-making and enable stakeholders to conduct in-depth analyses of the business’s performance.

In this blog, we will explore the R2R process, examine how it operates, highlight its advantages, and suggest strategies to optimize the R2R process.

What is R2R Process?

Record to report (R2R) is a financial management process that involves collecting, processing, and presenting accurate financial data. This process starts with recording all financial transactions in the accounting system.

The process is conducted in two distinct phases, with the first feeding into the second.

Record phase includes a series of steps designed to accurately capture and document all transactions or activities that affect the business's finances. The Report phase then takes this data and compiles it into financial documents used to assess the company’s overall performance and financial condition.

Both phases are equally important. The value of the reports produced in the second phase of the cycle is dependent on the quality of the data gathered and processed in the first phase. Therefore It is critical that the entire cycle be well administered, with minimal errors..

Over-view of R2R Process?

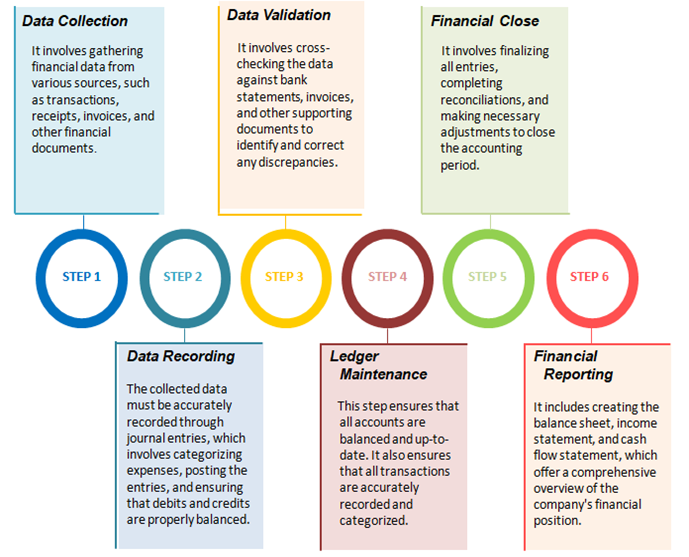

Record-to-report is a systematic approach to business accounting. Within the two phases outlined above, a number of steps and processes are executed to complete the cycle, which are Illustrated in the image below:

The potential benefits of maintaining a consistent and accurate R2R process are as follows:

- Leads to reliable financial reports by ensuring that all financial data is accurately collected and recorded.

- By establishing robust internal control over financial reporting (ICFR), it enables the organizations to close their books timely and generates the financial report in a timely manner.

- Ensure compliance with accounting standards, laws, and regulations, minimizing the risk of non-compliance penalties.

- Establishes a clear record of all financial transactions, making it easier to trace and verify data during audits.

While the R2R process offers many advantages, it also presents a number of challenges. One major issue is data inaccuracies caused by manual entry or system errors, which can compromise the integrity of financial reports. The lack of automation can further overwhelm finance teams, increasing the risk of errors and driving up operational costs.

Another challenge is managing compliance with constantly changing regulations. This requires continuous updates to processes and systems, which can be difficult to track and implement without a clear strategy. Additionally, inconsistent data across different departments, often due to a lack of standardized practices, can lead to unreliable reports and hinder effective decision-making.

To address these challenges, companies can implement automation tools and integrate systems to streamline the process and reduce manual errors. Standardizing data entry practices across departments and providing regular training on evolving regulations will help ensure accuracy and compliance.

To help readers gain a clearer understanding of the R2R process, here are some frequently asked questions (FAQs):

- What is R2R process?

The Record-to-Report (R2R) process is a critical part of financial management that encompasses the entire cycle from the initial recording of financial data to the generation of financial statements and reports. Record-to-report processes help companies evaluate their financial well-being and enhance decision-making with accurate and timely reports.

- What are the steps involved in R2R process?

Data collection, Journal Entry Preparation, Posting to General Ledger, Reconciliation, Financial Closings, Financial Reporting, Compliance and Auditing and lastly Performance analysis & management reporting

- What are the advantages of having a consistent R2R process?

The R2R process ensures accurate and timely financial reporting, improving decision-making and compliance. It streamlines financial operations by reducing manual errors and increasing efficiency. Additionally, it provides greater transparency, enabling better financial insights and strategic planning.

- How does R2R differ from P2P?

R2R stands for Record to Report, while P2P stands for Procure to Pay. R2R focuses on financial reporting, while P2P handles procurement and payment processes.

- What challenges arise in the R2R process, and how do you resolve them?

Challenges include data discrepancies, compliance issues and system errors.

Solutions involve robust internal controls, audits and automation tools.

- What tools or softwares are commonly used in R2R process?

SAP, Oracle, Quickbooks and Blackline are popular R2R tools.

- How does automation impact the R2R process?

Automation reduces errors, speeds up reconciliation and improves reporting accuracy.

- What role does R2R play in Audits?

Through R2R process, essential documents such as Journal entries, Reconciliations and supporting schedules are generated, which help the Auditor to review the validity and accuracy of Financial data. Along with that R2R process ensures the establishment of well maintained Internal control system, which Auditor reviews during Audit & Review process.

- Explain the difference between Accrual and Cash basis of accounting in R2R process?

In very lucid terms, Accrual accounting records transactions when they occur, while cash accounting records them when cash is exchanged.

Oops… I almost forgot to mention how we (Braj Aggarwal CPA, P.C.) can assist you in the R2R process!

In this process, we as a licensed CPA firm will assist by providing expertise in managing and ensuring the accuracy of financial reporting. We will help by reviewing financial data, ensuring compliance with accounting standards (US GAAP) and regulatory requirements, and ultimately assist in the preparation of financial statements. Moreover, we may offer services such as internal controls evaluation, reconciliations, and internal audits to ensure the integrity of the financial reporting process. Our role ensures that all financial transactions are properly recorded and reported, providing stakeholders with accurate and reliable financial information.