Preparing for an Audit: Essential Practices and Common Mistakes

Preparing for an audit is a crucial task that can significantly impact an organization’s financial health and compliance status. Whether you're managing a small business or overseeing a large corporation, the process can be intricate and demanding. Effective preparation not only streamlines the audit but also highlights opportunities for organizational improvement. The article below will outline key practices for audit preparation and highlights common errors to avoid.

Key Practices for Audit Preparation

1. Understand the Audit Scope and Requirements

- Begin by understanding the specific objectives of the audit, whether it is financial, compliance, or internal. Each audit type has unique focuses and requirements that need to be addressed.

- Familiarize yourself with applicable auditing standards and regulations. For financial audits in the U.S., this includes Generally Accepted Accounting Principles (GAAP) and the standards set by the American Institute of Certified Public Accountants (AICPA) or the Public Company Accounting Oversight Board (PCAOB) for public entities.

2. Organize and Review Financial Records

- Collect all necessary financial documents, including Balance sheets, Income statements, Cash flow statements, and supporting schedules. Ensure these documents are complete, accurate, and up-to-date.

- Conduct a thorough reconciliation of all accounts to confirm that transactions are accurately recorded and discrepancies are resolved before the audit commences.

3. Create a Comprehensive Audit Preparation Checklist

- Create a checklist of documents and tasks required for the audit, including financial statements, bank statements, tax returns, and contracts.

- Allocate specific tasks to team members to ensure that all items on the checklist are addressed and nothing is overlooked.

4. Ensure Compliance with Internal Controls

- Evaluate the effectiveness of your internal controls to ensure they are functioning properly. This includes examining segregation of duties, authorization procedures, and accurate record-keeping.

- Clearly document internal control processes and procedures. This documentation will help auditors understand how controls are implemented and evaluated.

5. Communicate Effectively with the Audit Team

- Schedule initial meetings with the audit team to discuss the scope, timeline, and specific requirements of the audit. This will help align expectations and address any uncertainties.

- Ensure that the audit team has access to necessary systems, records, and personnel. This includes providing access to financial systems, databases, and key staff members.

6. Conduct a Pre-Audit Self-Assessment

- Perform a self-assessment or mock audit to identify potential issues and areas of concern. This can help resolve problems before the official audit starts.

- If applicable, review previous audit reports and follow-up actions. This will provide insights into recurring issues or areas that need attention.

7. Prepare for Auditor Requests

- Be ready to answer questions related to your financial statements, internal controls, and business processes. Thorough knowledge of your records will facilitate smooth interactions with auditors.

- When presenting documents or explaining processes, ensure clarity and conciseness. Accurate and straightforward responses help build trust and credibility with the audit team.

Some of the Common Mistakes that entities should avoid

1. Inadequate Documentation

- Failure to provide complete and accurate documentation can lead to delays or audit findings. Ensure all documents are organized and easily accessible.

- Without adequate supporting evidence for transactions or balances, auditors may question the validity of financial statements. Maintain thorough documentation for all financial activities.

2. Poor Communication

- Ineffective communication with the audit team can result in misunderstandings and inefficiencies. Clearly convey any issues or concerns and keep communication lines open throughout the audit.

- Address any issues that arise during the audit promptly to avoid prolonged delays or complications.

3. Neglecting Internal Controls

- Weak or ineffective internal controls can lead to audit findings and potential financial misstatements. Regularly review and enhance your internal controls to ensure they are robust.

- Failing to adhere to internal control procedures can lead to compliance issues. Ensure all controls are consistently followed.

4. Last-Minute Preparation

- Waiting until the last minute to prepare can lead to rushed work and increased stress. Start preparation early to ensure all tasks are completed thoroughly and on time.

- Rushed preparation may result in overlooked errors or issues. Allow sufficient time for review and correction of documents before the audit begins.

5. Ignoring Previous Audit Findings

- If prior audits identified issues or recommendations, ensure they have been addressed before the new audit starts. Ignoring past findings can lead to recurring issues and potential complications.

Frequently Asked Questions (FAQ):

What are the key steps to take when preparing for an audit?

Start by organizing all financial records, contracts, and other documentation. Ensure compliance with accounting standards, communicate with your audit team, and review previous audit findings to address any prior issues.

What common mistakes should businesses avoid during an audit?

Some common mistakes include lack of documentation, poor communication with auditors, failure to understand audit requirements, and insufficient internal controls. Ensure timely responses and preparation to avoid these pitfalls.

How can businesses ensure compliance with audit regulations?

Stay updated on regulatory changes, implement strong internal control systems, regularly review financial processes, and conduct internal audits before the official audit to identify and fix any issues.

How far back should financial records be kept for an audit?

Generally, businesses should keep records for at least seven years, though this may vary depending on specific industry regulations or auditor requirements.

What should businesses expect during an audit process?

Expect auditors to review your financial statements, internal controls, and compliance with regulations. Auditors may ask questions, request additional documents, and recommend adjustments based on their findings.

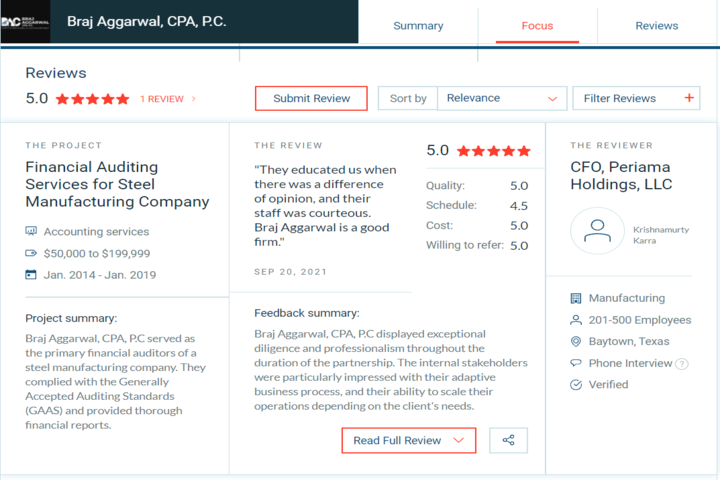

How Braj Aggarwal CPA, P.C will help?

A CPA firm plays a crucial role in streamlining and simplifying audit preparation services. At Braj Aggarwal CPA, P.C., we guide you through the audit process, ensuring clarity on what the audit will cover while helping to organize and verify all financial documents. We provide comprehensive checklists to track necessary tasks and review internal controls to confirm they meet industry standards. With our expertise, you can ensure thorough preparation, avoid common mistakes, and implement improvements based on audit findings.

For more information or assistance, connect with us at Braj Aggarwal CPA, P.C.