How CPAs Are Evolving into Strategic Business Advisors

In today's competitive business landscape, Certified Public Accountants (CPAs) are transforming from traditional number crunchers into pivotal strategic advisors. Their evolving role extends beyond basic accounting tasks, allowing them to guide businesses through complex financial challenges and contribute significantly to long-term success.

Here’s how CPAs are making this shift and why it matters for your business.

The CPA as Your Business’s Growth Catalyst

Partnering with a CPA can significantly impact your business’s financial health and growth. These experts are adept at navigating complex tax regulations, ensuring compliance, and uncovering opportunities for tax savings. They offer precise and transparent financial reporting, which is crucial for making informed decisions and building strong business relationships. Moreover, CPAs use their expertise to analyze financial data, revealing key insights that help identify trends and make strategic decisions. Their guidance extends to crafting long-term growth strategies, including expansion, investments, and mergers, all aimed at propelling your business forward.

Adapting to a Changing Landscape

As the business environment becomes more intricate, the role of CPAs has expanded significantly. Technological advancements, evolving business structures, and increasing regulations have led CPAs to adapt and grow. Today, they are not just financial managers but versatile professionals who offer strategic guidance in various areas. CPA firms are now viewed as trusted partners and advisors, playing essential roles in financial planning, risk management, and strategic decision-making.

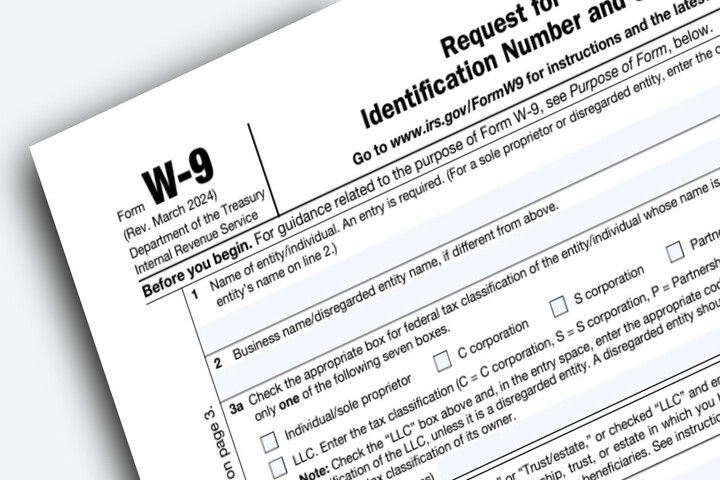

- Regulatory Navigation: CPAs leverage their deep knowledge of regulatory frameworks to assist organizations in managing complex compliance requirements.

- Data-Driven Insights: Their ability to analyze financial data provides valuable insights, enabling businesses to enhance operational efficiency and profitability.

- Addressing Modern Challenges: With increasing concerns about fraud and sustainability, CPAs are embracing roles in forensic accounting and sustainability reporting to tackle these critical issues.

- Harnessing Technology: CPAs are proficient in new technologies, using data analytics and innovative solutions to drive business growth.

Transitioning into Strategic Advisors

The role of CPAs is evolving to meet the demands of a changing financial landscape. Here’s how they are transitioning into strategic advisors:

- Adoption of Technology: With the decline of manual bookkeeping, CPAs now utilize advanced accounting tools integrated with machine learning and artificial intelligence. These technologies support predictive analysis and financial forecasting, enabling CPAs to offer strategic insights and contribute to high-level decision-making.

- Enhanced Client Communication: Moving beyond traditional roles, CPAs focus on client-centric communication. They engage in discussions about growth strategies, business vision, and risk management, which helps build stronger relationships and a deeper understanding of client needs and challenges.

- Advanced Risk Management: In today’s volatile business environment, CPAs are expanding their roles to include comprehensive risk and crisis management. They identify potential risks, develop mitigation strategies, and establish risk management frameworks to help businesses manage financial uncertainties effectively.

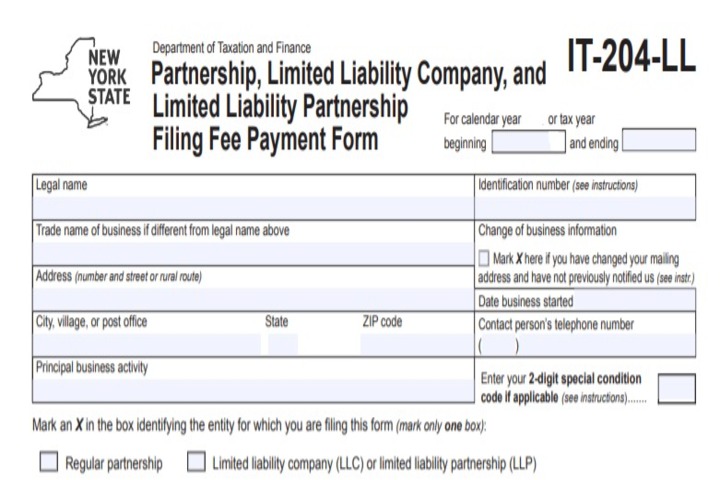

- Strategic Compliance Management: As financial regulations evolve, CPAs play a critical role in compliance management. They go beyond using technology for compliance and provide strategic financial planning to ensure that business goals align with regulatory requirements and revenue optimization.

By leveraging their extensive expertise and embracing new tools and technologies, CPAs are increasingly positioned as strategic advisors. Their ability to turn complex financial data into actionable strategies is essential for guiding businesses towards sustainable growth and long-term success.

FAQs on How CPAs Are Evolving into Strategic Business Advisors

How are CPAs evolving into strategic business advisors?

Traditional CPAs focused mainly on financial reporting, compliance, and tax preparation. However, modern CPAs are becoming more proactive, offering data-driven insights and helping businesses make informed strategic decisions. They assist in areas such as financial planning, risk management, operational efficiency, and business growth.

What kind of strategic advice can CPAs offer businesses today?

CPAs can advise on financial forecasting, budgeting, cost management, investment planning, mergers and acquisitions, cash flow optimization, and even digital transformation strategies. Their deep understanding of financial data makes them valuable partners in setting long-term business goals.

How does being a strategic business advisor benefit a business?

By leveraging CPAs as strategic advisors, businesses can make smarter decisions based on financial and operational data. This helps businesses minimize risks, maximize profitability, and create a competitive edge in the market.

What skills make modern CPAs effective as business advisors?

Modern CPAs possess strong analytical skills, business acumen, and a deep understanding of both financial and operational metrics. They are adept at using technology and data analytics to offer insights that drive better decision-making and long-term strategy.

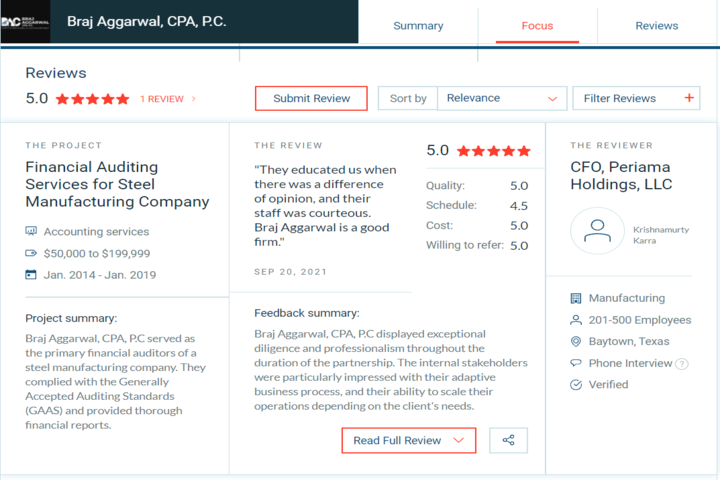

How can Braj Aggarwal, CPA, P.C. help businesses transition to using CPAs as strategic advisors?

Braj Aggarwal, CPA, P.C. helps businesses evolve by offering tailored business advisory services, identifying key financial insights, and creating long-term growth strategies. We work closely with clients to understand their unique needs and challenges, then provide comprehensive solutions that go beyond traditional accounting functions.

With a focus on building strong, collaborative relationships, Braj Aggarwal, CPA, P.C. enables businesses to unlock new opportunities and achieve their strategic goals.

The Evolving Role of Braj Aggarwal, CPA, P.C

Braj Aggarwal, CPA, P.C are incredibly valuable to businesses today. They do more than just handle numbers—they offer essential advice that helps businesses thrive. By using their financial expertise, they guide businesses through complex challenges and opportunities. They use advanced tools to predict future trends and create smart strategies, making sure that a company’s money is used wisely for long-term success. They also help with managing risks and complying with regulations, acting as trusted partners in achieving business goals.

Let us be your trusted advisor and strategic partner on the journey to achieving exceptional business growth. Reach out today to discover the transformative power of expert financial guidance.