How a CPA Can Streamline Your Business Setup

Starting a business in the United States can seem like a big task with many steps, but breaking it down can make it manageable. From figuring out what kind of business you want to run, to handling legal paperwork, to finding customers, there's a lot to think about. You'll need to make decisions about where to set up your business in USA, how to organize it, and how to fund it. By taking it one step at a time, you can turn your business idea into a successful reality.

Here are the steps you should follow to achieve your dream goal:

Step 1:- Conducting Market Research

Before launching a business, it's essential for entrepreneurs to conduct thorough market research. This involves understanding your target audience, assessing competition, and identifying market trends. Key factors to examine include demand, market size, location, competition, and pricing. Market research should also cover opportunities within the market, potential barriers to entry, industry trends, and a detailed analysis of competitors' strengths, weaknesses, and market share.

Step 2:- Crafting a Business Plan

A comprehensive business plan serves as a blueprint for your business, guiding development, daily operations, and growth strategies. It is often required by financial institutions when applying for loans or other forms of funding. Business plans vary based on the company’s needs and should focus on what is most relevant to the specific business. They typically come in two formats: traditional and lean start-up. The traditional format is more detailed and suited for businesses with complex needs, while the lean start-up plan offers a concise overview with fewer elements, making it ideal for simpler businesses or those likely to update their plan frequently.

Step 3:- Reviewing Funding Options

Funding a business depends on its specific needs and the owner's vision and financial situation. Start by calculating your start-up costs: list all expenses and estimate their amounts through research and quotes. Next, decide how to secure the funds. Common options include bootstrapping, venture capital, crowd-funding, or obtaining a loan from a bank, online lender, or credit lender. Regardless of the method chosen, it’s crucial to outline how the funds will be used and create a financial plan that includes sales projections and loan repayment strategies.

Step 4:- Understanding Legal Requirements

In the U.S., businesses must adhere to regulations at local, county, state, and federal levels. Local rules cover zoning, business licenses, and safety codes. County regulations may involve permits and environmental rules. State requirements include business registration, state taxes, and industry licenses. Federal regulations from agencies like the IRS and OSHA address tax IDs and labor laws. Keeping up with these requirements is essential to avoid penalties and ensure smooth operation.

Step 5:- Choosing a Business Location

The location of a business impacts various factors such as taxes, zoning laws, and the need for licenses and permits. When choosing a location, consider the following:

- Human Factors: Think about your target audience and the preferences of business owners and partners, including convenience, familiarity with the area, and commuting distances.

- Regulations: Compliance with local, county, state, and federal regulations is necessary.

- Regional Costs: Evaluate local expenses like salaries, property or rental prices, insurance rates, utilities, and government fees.

- Tax and Financial Environment: Be aware of different taxes (income, sales, corporate, property) and financial incentives, such as tax credits and loan programs, which may vary by location.

Step 6:- Picking a Business Structure

Choosing the right business structure is crucial as it affects ownership, liability, and taxes. Some of the common business structures are as below for your better understanding:

-

Sole Proprietorship: This is the simplest form, with one owner who reports business income on their personal tax return.

-

Partnership: There are two main types: Limited Partnership (LP), where some partners have limited liability, and Limited Liability Partnership (LLP), which offers protection from personal liability for business debts.

-

Limited Liability Company (LLC): An LLC protects its owners from personal liability for business debts and offers flexible tax options.

-

Corporation: Corporations can be structured as C Corporations, S Corporations, B Corporations, closed corporations, or nonprofits, each with different legal and tax implications.

Author’s Note:- Setting up an LLC is easier and involves less paperwork than forming a corporation. LLCs allow flexible tax options and require an operating agreement to define member roles. Corporations come in two types: S corporations pass income and losses to owners for tax purposes, while C corporations are taxed separately and can keep profits within the company.

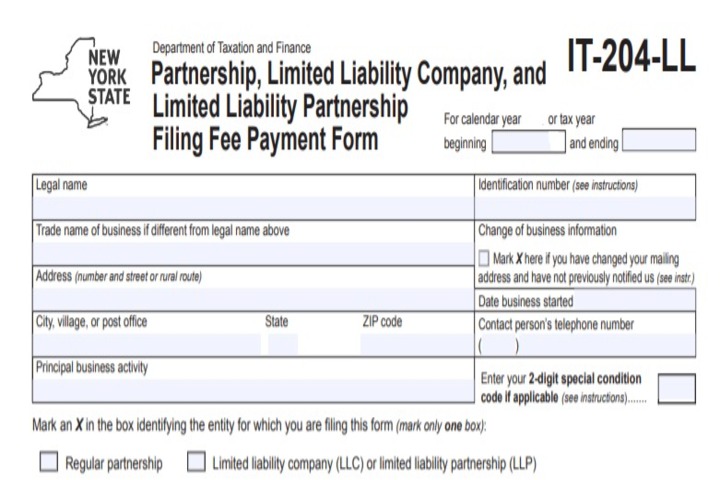

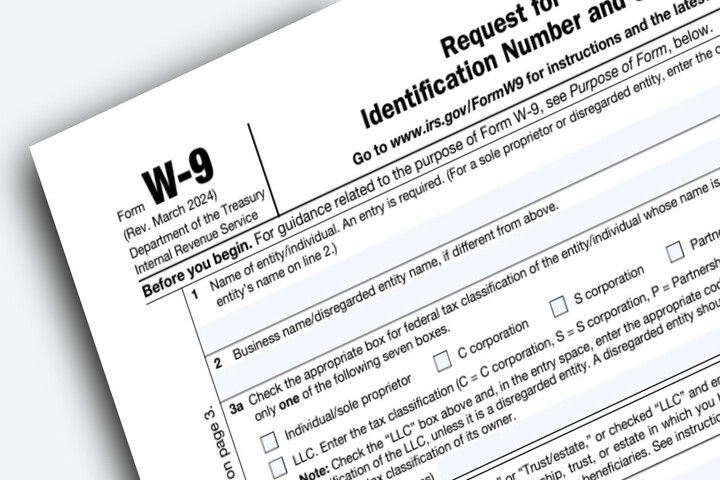

Step 7:- Getting a Tax ID Number

A tax ID number acts like a Social Security number for a business. Whether you need a state or federal tax ID depends on your business type and location. A federal tax ID, or EIN, is necessary if your business is a corporation or partnership, pays federal taxes, has employees, or needs to file certain tax returns. It's also useful for opening a business bank account, offering retirement plans, or applying for permits. You can get an EIN online from the IRS, and state tax IDs are available through state websites.

Step 8:- Registering a Business

Registering a business depends on its location, type, and structure. For some small businesses, just registering the business name with local and state authorities may be enough, while others might need more extensive registration for benefits like personal liability protection and trademark rights.

Step 9:- Obtaining Permits

Securing the necessary government licenses and permits for your business depends on its industry and location. You may need to apply to federal, state, county, or city agencies.Common licenses and permits might include:

-

Federal Business License: For specific regulated activities.

-

State Business License: Varies by state.

-

County Permit: For local zoning and land use.

-

City Permit: For local operating requirements and health codes.

-

Industry-Specific Licenses: Such as those for restaurants, healthcare providers, or construction businesses.

Oops, we forgot to mention the final and most crucial step:

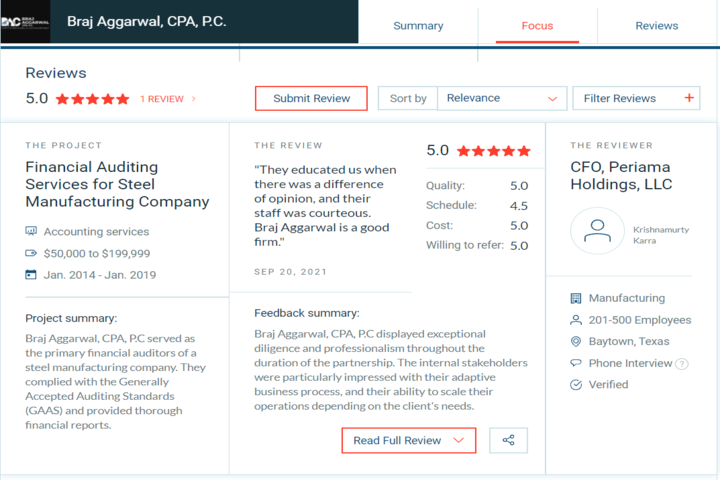

Step 10:- Role of a CPA in setting up a business in the USA and how Braj Aggarwal, CPA, PC can assist

We as a licensed CPA firm in New York will assist you with every step of starting your business, from identifying and estimating initial costs like equipment, licenses, and permits to creating a detailed budget for financial planning. Our team will help you navigate complex legal and tax requirements, ensuring you meet all local, state, and federal regulations. We’ll also support you in developing a solid business plan with financial projections and help set up effective accounting systems. Additionally, we can assist in obtaining the necessary licenses and permits. Once your business is up and running, we’ll continue to offer ongoing support by monitoring financial performance, providing tax planning advice, and assisting with financial reporting.

Let’s contact Braj Aggarwal, CPA, P.C today and make us as a partner in your success.