Everything You Need to Know About New York City Sales Tax

Navigating through New York City's sales tax system may seem daunting, but it doesn't have to be. This comprehensive guide will provide a detailed breakdown of everything you need to know about the sales tax rate, exemptions, and who is accountable for payment in the city.

Understanding the Sales Tax Rate in New York City:

The Big Apple boasts the highest combined sales tax rate in the state, standing at 8.875%. This rate consists of three components:

* 4.5% New York City Sales Tax: Applicable to most retail sales within the city limits.

* 4% New York State Sales Tax: Applicable to all sales within New York State.

* 0.375% Metropolitan Commuter Transportation District (MCTD) Surcharge: Imposed on sales made in New York City and specific surrounding counties.

Taxable Items and Exemptions:

Sales tax is levied on most goods and services sold at retail establishments in New York City. Nonetheless, certain items are exempt, including:

Essential Goods, such as clothing and footwear under $110, unprepared food, medicine, and diapers, are exempt from city, state, and MCTD sales taxes.

Manufacturing and Repair: Certain items used in clothing manufacturing and repair are also exempt.

Select Services: While New York State exempts some services from sales tax, they may still be subject to city and MCTD taxes. These services include barbering, hair removal, manicures, massages, tanning, tattooing, gyms, and weight loss centres.

Responsibility for Sales Tax Payment:

Businesses hold the responsibility for collecting and remitting sales tax to the government, encompassing city sales tax, state sales tax, and the MCTD surcharge. Consumers typically see the sales tax included in the final price they pay.

Filing Sales Tax Returns:

Businesses operating in New York City must file sales tax returns with the state. This process can be completed through the state's Sales Tax Web File site or, for businesses surpassing specific thresholds, via the PrompTax program.

Deducting NYC Sales Tax:

It is possible to deduct NYC sales tax through the federal SALT deduction (State and Local Taxes). However, there are notable limitations:

Only available for itemized deductions: You must opt to itemize deductions on your tax return, which may not always be the most beneficial choice.

Capped Amount: The SALT deduction is capped at $10,000 for joint filers.

Choice Between Sales & Income Tax: The SALT deduction necessitates a selection between deducting state and local income taxes or sales taxes, not both.

FAQ

What is New York City Sales Tax?

New York City Sales Tax is a tax imposed on the retail sale of tangible personal property and certain services within the five boroughs of New York City (Manhattan, Brooklyn, Queens, The Bronx, and Staten Island).

Do I need to register for New York City Sales Tax?

If you conduct business in New York City and sell taxable items or services, you are generally required to register for sales tax purposes with the New York State Department of Taxation and Finance.

When do I need to file and remit New York City Sales Tax?

Sales tax returns and payments are typically due on a quarterly basis. The due dates are generally on the 20th day of the month following the end of each quarter (March 20th, June 20th, September 20th, and December 20th).

What are the consequences of not complying with New York City Sales Tax regulations?

Failure to comply with New York City Sales Tax regulations can result in penalties, fines, and legal consequences. It's important to ensure proper compliance to avoid such repercussions.

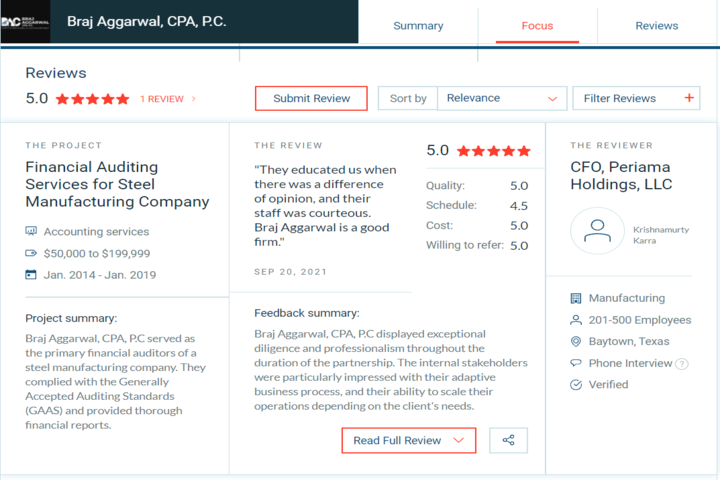

Searching Best Consulting CPA Firm in New York for Your Taxation Service?

Considering the complexity of tax deductions, consulting a reputable Certified Public Accountant (CPA) in New York, such as Braj Aggarwal, CPA, P.C. is highly recommended to determine the best course of action for your specific tax situation.