CPAs: Essential Partners for Business Conducting Wage Parity Audit

Certified Public Accountants (CPAs) are essential partners for businesses conducting wage parity audits. CPAs have the training, experience, and skills necessary to conduct comprehensive and accurate wage parity audits. They can also help businesses to understand the findings of the audit and develop plans to address any identified disparities.

Here are some of the ways that CPAs can help businesses with wage parity audits:

- Collect and analyze wage data: CPAs have the experience and expertise to collect and analyze complex wage data. They can identify any potential disparities in pay between employees of different genders, races, and other demographics.

- Understand pay practices: CPAs have a deep understanding of pay practices and compensation laws. They can help businesses to identify any areas where their pay practices may be unfair or discriminatory.

- Develop and implement audit plans: CPAs can develop and implement audit plans that are tailored to the specific needs of each business. They can also work with businesses to develop and implement corrective action plans to address any identified disparities.

- Provide guidance and support: CPAs can provide guidance and support to businesses throughout the wage parity audit process. They can answer questions, explain the findings of the audit, and help businesses to develop plans to address any identified disparities.

Here are some examples of how CPAs have helped businesses with wage parity audits:

- A CPA helped a large retail company to identify and address a gender pay gap of 15%. The CPA worked with the company to develop new pay policies and procedures that ensured that employees were paid fairly, regardless of gender.

- A CPA helped a technology company to identify and address a racial pay gap of 10%. The CPA worked with the company to develop new hiring and promotion practices that ensured that all employees had an equal opportunity to succeed.

- A CPA helped a manufacturing company to identify and address a disability pay gap of 5%. The CPA worked with the company to develop new accommodations and support programs for employees with disabilities.

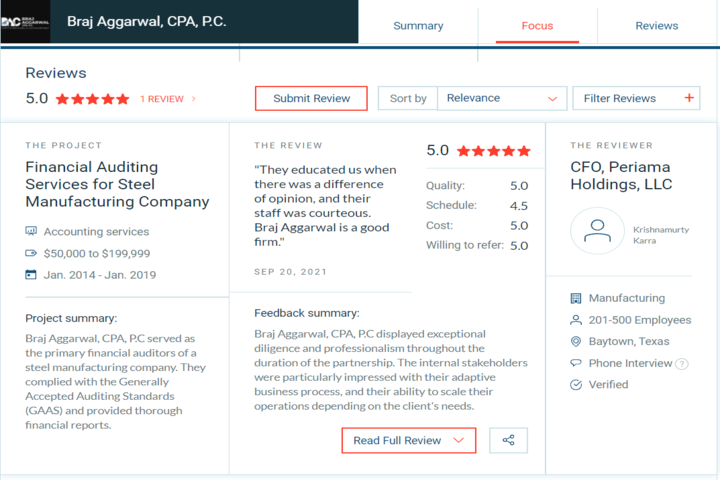

If you are a business owner or manager and searching reputed and experienced CPA firm to conduct a wage parity audit then Braj Aggarwal, CPA, P.C. firm is the best option for your wage parity audit.They can help you and ensure that your employees are paid fairly and equitably, and that your business is in compliance with all applicable wage and compensation laws.